Bajaj Finserv Insta EMI Card Offers Instant Approval & a High Loan Limit for Easy Purchases

By ANI | Updated: April 25, 2025 15:02 IST2025-04-25T14:58:56+5:302025-04-25T15:02:17+5:30

HT Syndication Pune (Maharashtra) [India], April 25: Bajaj Markets, a digital financial marketplace, brings a smarter way to handle ...

Bajaj Finserv Insta EMI Card Offers Instant Approval & a High Loan Limit for Easy Purchases

HT Syndication

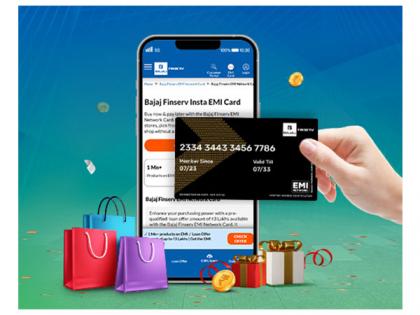

Pune (Maharashtra) [India], April 25: Bajaj Markets, a digital financial marketplace, brings a smarter way to handle summer shopping, with the Bajaj Finserv Insta EMI Card. As temperatures rise, now is the perfect time to invest in home with cooling appliances, smart gadgets, or kitchen essentialsall without straining monthly budgets.

The Bajaj Finserv Insta EMI Card offers a pre-qualified card loan limit of up to Rs3 Lakhs and is accepted at more than 1.5 lakh partner stores across over 4,000 cities. Purchases can be made easily and repaid through simple, monthly instalments, making it a hassle-free way to manage expenses while upgrading household essentials.

Why Choose the Bajaj Finserv Insta EMI Card

The Insta EMI Card brings together flexibility and convenience, making it a preferred choice for purchases: Here's why this card is the perfect shopping companion:

Card Loan Limit of up to Rs3 Lakhs

Immediate access to a high-value pre-qualified amount for purchasing electronics, appliances, and more.

Easy EMI

Purchases can be converted into monthly instalments, easing financial planning.

Flexible Tenure

Repayment periods of up to 60 months provide ample flexibility to manage outflows as per preference.

Accepted at 1.5 Lakh+ Stores

Usable at over 1.5 lakh partner stores in 4,000+ cities, enabling extensive coverage and choice.

No Annual Fees

The card does not attract annual maintenance charges, ensuring greater savings.

Instant Approval

Get approved within minutes and start shopping right away, without waiting for long processing times.

Completely Digital Process

The entire application and setup can be completed online within minutes, with no physical paperwork required.

Who Can Apply - Eligibility Criteria

To access these shopping benefits, individuals must meet the following eligibility criteria:

* Must be an Indian citizen between 21 and 65 years of age

* Must have a stable and regular source of income

* Must hold a good credit score as per the Bajaj Finance risk policies

Apart from the Insta EMI Card, Bajaj Markets also provides access to a broad suite of financial products such as loans, insurance, credit cards, and investment solutionsall accessible through its website and app.

About Bajaj Finserv Direct

Bajaj Finserv Direct, a subsidiary of Bajaj Finserv, is one of the fastest-growing fintech companies in India. It has two primary arms, Bajaj Markets, a financial marketplace, and Bajaj Technology Services, a techfin service provider.

Bajaj Markets is a marketplace that offers multiple financial products across all categories - Loans, Cards, Insurance, Investments, Payments, Pocket Insurance, and VAS. Bajaj Markets has partnered with trusted financial brands to offer "India ka Financial Supermarket". A one-stop destination where its customers can explore a host of products that can help them achieve their financial life goals.

Having started its journey as a fintech, Bajaj Finserv Direct has also built a very strong business as a techfin. Through Bajaj Technology Services it offers a wide gamut of digital technology services which span Custom Applications, Enterprise Applications, Data & Analytics, Gen AI, Cloud Services and Digital Agency.

Visit the Bajaj Markets website or download the Bajaj Markets' app from the Play Store or App Store to experience "India ka Financial Supermarket".

(ADVERTORIAL DISCLAIMER: The above press release has been provided by HT Syndication.will not be responsible in any way for the content of the same)

Disclaimer: This post has been auto-published from an agency feed without any modifications to the text and has not been reviewed by an editor

Open in app