Good News for Tax Payers: Income Tax Department will refund late payment fee deducted for ITR

By Lokmat English Desk | Updated: August 12, 2021 10:43 IST2021-08-12T10:29:29+5:302021-08-12T10:43:48+5:30

Income Tax Department has decided to return wrongly deducted late payment fee for ITR applicants earlier this month. This ...

Good News for Tax Payers: Income Tax Department will refund late payment fee deducted for ITR

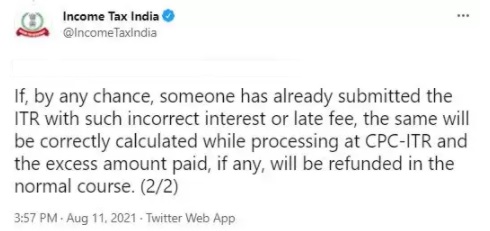

Income Tax Department has decided to return wrongly deducted late payment fee for ITR applicants earlier this month. This will be a relief for all the taxpayers who have faced problems due to late payment fee cuts. After filing return ITR on July 30, the Income-tax department has said that people whose late payment fees and additional interest have been deducted will be reimbursed.

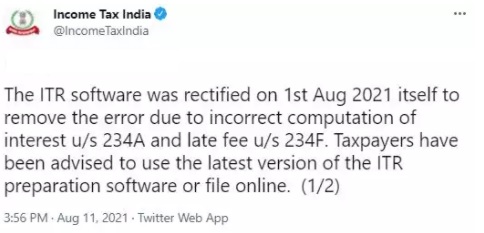

According to the Income Tax Department, the late fee was deducted due to a problem with the ITR software. But it was fixed on August 1. Due to this error, the interest under section 234A and the late payment fee under section 234F of the people who filed ITR after July 30 were being miscalculated and deducted from the account of the people.

What's the whole matter?

Many had to face problems since the Income Tax Department launched a new portal (Income Tax new Website). A new problem had arisen earlier this month. Late payment penalty was deducted from those who filed income tax after July 31. The deadline has now been extended to September 30. Normally, the last date to file an income tax return is July 31. However, the date has been postponed on the backdrop of Coronavirus and the date has been fixed for September 30.

How much was the late payment fee?

According to section 234F of the Income Tax Act, if a taxpayer files a return after July 31 and by December 31, he can be fined Rs 5,000. After December, the maximum fine was Rs 10,000.

Income Tax Department has decided to return wrongly deducted late payment fee for ITR applicants earlier this month. This will be a relief for all the taxpayers who have faced problems due to late payment fee cuts. After filing return ITR on July 30, the Income-tax department has said that people whose late payment fees and additional interest have been deducted will be reimbursed.

According to the Income Tax Department, the late fee was deducted due to a problem with the ITR software. But it was fixed on August 1. Due to this error, the interest under section 234A and the late payment fee under section 234F of the people who filed ITR after July 30 were being miscalculated and deducted from the account of the people.

What's the whole matter?

Many had to face problems since the Income Tax Department launched a new portal (Income Tax new Website). A new problem had arisen earlier this month. Late payment penalty was deducted from those who filed income tax after July 31. The deadline has now been extended to September 30. Normally, the last date to file an income tax return is July 31. However, the date has been postponed on the backdrop of Coronavirus and the date has been fixed for September 30.

How much was the late payment fee?

According to section 234F of the Income Tax Act, if a taxpayer files a return after July 31 and by December 31, he can be fined Rs 5,000. After December, the maximum fine was Rs 10,000.

Open in app