'RBI's rate cut move commendable, will boost consumption'

By IANS | Updated: April 9, 2025 20:11 IST2025-04-09T20:06:35+5:302025-04-09T20:11:51+5:30

Mumbai, April 9 The Reserve Bank of India’s (RBI) decision to reduce the repo rate by 25 basis ...

'RBI's rate cut move commendable, will boost consumption'

Mumbai, April 9 The Reserve Bank of India’s (RBI) decision to reduce the repo rate by 25 basis points to 6 per cent was timely and appreciated, an expert said on Wednesday.

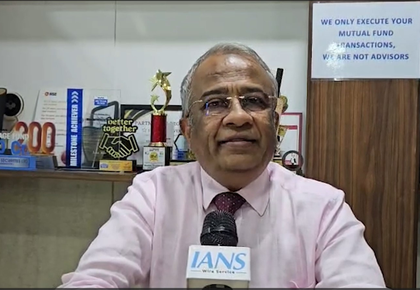

The central bank’s step will help revive domestic consumption as the move will encourage spending, stock market expert Sunil Shah told IANS.

He added that the RBI’s move is commendable. Earlier, the government had provided relief through the Budget and income tax concessions, which put more disposable income in people’s hands, he added.

"Now, with the RBI cutting rates again, it strengthens the effort to boost consumption. There were concerns about weak demand before January, but this decision will encourage spending," Shah told IANS.

However, he cautioned that the effects won’t be immediate. “We won’t see the impact of this rate cut overnight.”

"It will take two to three quarters before signs of recovery in consumption are visible. Eventually, people will start spending more, which will benefit the economy and GDP growth," he noted.

He also commented on the broader global economic environment, particularly the concerns around a potential trade war triggered by US President Donald Trump’s tariff measures.

"Trump has long spoken about tariffs, and when he finally acted last week, it shook global stock markets. Indian markets also declined, though less than others," he mentioned.

Shah added: "Markets briefly recovered on Tuesday, supported by European and US markets opening strong. But with the US announcing additional tariffs on China, fears of a full-blown trade war returned."

He stressed that trade wars hurt everyone. "There are no winners in a trade war. If the situation escalates, it could push up inflation in the US, hurting consumer spending and weakening demand."

If inflation grips the world’s largest economy, the consequences will spill over to the global economy, he warned.

The central bank has also downgraded its GDP forecast for FY26 to 6.5 per cent, from 6.7 per cent earlier -- pointing to risks from global tariff hikes and weak investor sentiment.

Disclaimer: This post has been auto-published from an agency feed without any modifications to the text and has not been reviewed by an editor

Open in app