Maharashtra Shocker: Marriage in Akola Called Off Over Groom's Low CIBIL Score

By Lokmat English Desk | Updated: February 7, 2025 10:49 IST2025-02-07T10:49:06+5:302025-02-07T10:49:46+5:30

When banks provide loans, they assess not just the borrower’s ability to repay, but also their ‘CIBIL score.’ A ...

Maharashtra Shocker: Marriage in Akola Called Off Over Groom's Low CIBIL Score

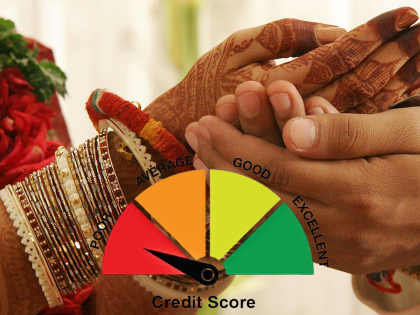

When banks provide loans, they assess not just the borrower’s ability to repay, but also their ‘CIBIL score.’ A strong CIBIL score can often lead to lower interest rates on loans, while a poor score may result in higher rates. In some cases, a low CIBIL score could even cause the bank to deny the loan. However, it's rare for a marriage to be directly affected by someone's CIBIL score.

In Murtizapur, two families began negotiating a marriage proposal for their children. After agreeing on basic preferences, discussions proceeded to finalize the arrangement. During a meeting at the groom's house, the bride’s uncle insisted on checking the groom's CIBIL score. What followed was a surprising revelation — a lesson in financial literacy. The groom’s entire financial history was exposed through his CIBIL score, leaving his family speechless. This situation highlighted the growing importance of financial awareness in modern times.

... So, should the girl marry him?

It was revealed that the groom had a disturbingly low CIBIL score. His financial background, including loans taken from multiple banks, became public knowledge. As the details of his debts came to light, the once-lighthearted meeting turned serious. The bride’s uncle remarked, “If the groom is financially unstable, why should we give our daughter to him?”