Union Budget 2022: Tax rebate limit raised from ₹5 lakh to ₹7 lakh

By Lokmat English Desk | Updated: February 1, 2023 12:35 IST2023-02-01T12:29:25+5:302023-02-01T12:35:02+5:30

In a major announcement, Govt hiked income tax rebate limit to ₹7 lakh under the new tax regime. “I introduced ...

Union Budget 2022: Tax rebate limit raised from ₹5 lakh to ₹7 lakh

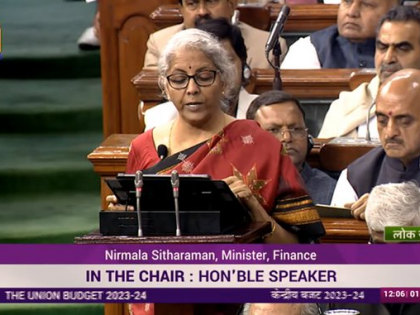

In a major announcement, Govt hiked income tax rebate limit to ₹7 lakh under the new tax regime. “I introduced in 2020, the new personal income tax regime with 6 income slabs, starting from Rs 2.5 Lakhs. I propose to change the tax structure in this regime by reducing the number of slabs to 5 and increasing the tax exemption limit to Rs 3 Lakhs,” the Finance Minister announced. This will be the last full Budget of the second Narendra Modi government ahead of general elections in 2024. The Union Budget 2023 might not offer any major relief to households due to fiscal restraints.

It would focus on long-term growth instead. Finance Minister Nirmala Sitharaman is expected to announce increase in budget allocations for health, education and rural projects, helped by a pick up in tax collections. She might tweak tax rules including an alteration to the structure of capital gains tax, which would encourage investments. If media reports that the new tax regime is likely to be made more attractive in the coming budget 2023 prove correct, then it is likely that this may also signal the end of the old tax regime. This appears the logical consequence of sweetening the new 'concessional tax regime' by introduction of a few limited exemptions/tax deductions and/or hiking the basic exemption limit.

Tax announcements

0-3 lakh nil

3-6 lk 5%

6-9 lk 10%

9-12 lk 15%

12-15 lk 20%

above 15 30%

New standard deduction for salary of 5 lac to be benefit upto 52,000