Union Budget 2024: LTCG Tax Hiked to 12.5%, STCG to 20%, STT on F&O Rises

By Lokmat English Desk | Updated: July 23, 2024 13:43 IST2024-07-23T13:41:39+5:302024-07-23T13:43:32+5:30

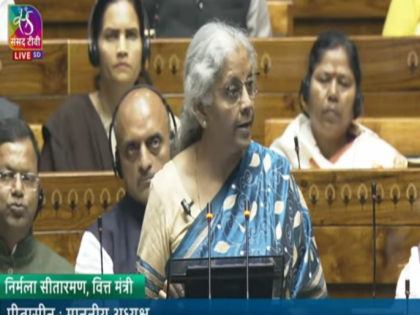

On Tuesday, July 23, 2024, Finance Minister Nirmala Sitharaman announced an increase in the long-term capital gains (LTCG) tax ...

Union Budget 2024: LTCG Tax Hiked to 12.5%, STCG to 20%, STT on F&O Rises

On Tuesday, July 23, 2024, Finance Minister Nirmala Sitharaman announced an increase in the long-term capital gains (LTCG) tax rate from 10% to 12.5% on all financial and non-financial assets as part of the Union Budget 2024-25. Additionally, she raised the short-term capital gains (STCG) tax on "certain" financial securities from 15% to 20%. However, Sitharaman also announced an increase in the exemption limit for long-term capital gains tax to Rs 1.25 lakh from Rs 1 lakh in specific cases.

Previously, the LTCG tax on the sale of asset classes such as stocks, mutual funds, and real estate was applicable when the holding period exceeded one year, while the STCG tax was imposed when these assets were sold within one year of purchase. Moreover, Sitharaman stated that unlisted bonds, debentures, debt mutual funds, and market-linked debentures would attract capital gains tax at the applicable rates regardless of the holding period.

This was the first Budget presented by the Narendra Modi-led government in Delhi and marked Sitharaman's seventh consecutive Budget presentation. Following the announcement, the BSE Sensex plummeted by 1,278 points in intraday trading, reaching a low of 79,224. The Nifty50 also hit a low of 24,074. Meanwhile, the BSE MidCap and SmallCap indices fell by up to 3.96% in intraday trading.

Open in app