RBI Ombudsman Fines Bandhan Bank ₹20,000 for Denying Senior Citizens FD Interest

By Amit Srivastava | Updated: October 1, 2024 17:24 IST2024-10-01T17:09:55+5:302024-10-01T17:24:38+5:30

A senior citizen couple from Koparkhairane successfully won a case against a private sector bank at the RBI Banking ...

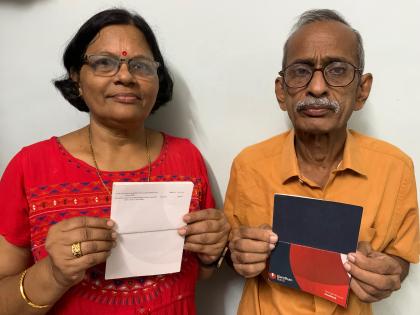

Bandhan Bank compensated Rs 10,000 each to Gupta couple after RBI Banking Ombudsman order

A senior citizen couple from Koparkhairane successfully won a case against a private sector bank at the RBI Banking Ombudsman and received compensation of Rs 10,000 each. The dispute arose when the bank failed to credit one day's interest on their fixed deposits (FDs).

The couple had transferred the FD amounts online on the night of January 15, 2024, but the FD receipts showed a booking date of January 16, 2024. When they raised the issue with the bank, customer care acknowledged that the FDs had indeed been processed on January 15. However, the case was closed with the explanation that the system had assigned a value date of January 16, and the matter had been addressed by branch officials.

Deepak Gupta, 67, had processed multiple FDs with Bandhan Bank on January 15, 2024, while his wife, Rama Gupta, 64, processed one FD the same night. The next day, they noticed the booking dates reflected January 16 instead of January 15. They filed a formal complaint with the bank, but the bank closed it on February 8, 2024, stating that the system was designed this way.

Unsatisfied, their son, Anuj Gupta and Amit Gupta, escalated the matter to the RBI Banking Ombudsman, submitting all relevant details. After six months of hearings, the Ombudsman found the bank at fault. Although the bank had credited Rs 39 to Rama Gupta and Rs 147 to Deepak Gupta as interest on March 19, 2024, the Ombudsman ruled that the bank had failed to provide the correct interest for one of their FDs. As a result, the bank was ordered to compensate the couple with Rs 10,000 each.

The Ombudsman's email to the complainants confirmed that the penalty was imposed after a careful examination of the case.

In its order, the bank stated: "In connection with your complaint regarding the value dating of your Fixed Deposit, the matter was taken up with the RE (Bandhan Bank). The RE has since credited the differential interest to the customers' accounts on March 15, 2024. Additionally, a compensation of Rs 10,000/- was credited to the customers' accounts on September 19, 2024, for mental harassment."

Anuj Gupta expressed relief at the outcome but noted that many customers may not notice such discrepancies, or, even if they do, may not pursue the issue. “A large amount of money that rightfully belongs to customers often goes unclaimed,” he said.

Open in app